Cava's Future: Growth Strategies for a Sparkling Wine at a Crossroads

- Introduction

- Wine and Cava specific growth rates

- Overall wine market decline

- Sparkling wine outlook and category divergence

- Cava’s performance relative to competing sparkling wines

- Lessons from Prosecco’s success

- Growth areas for Cava

- Market selection methodology

- Growth markets identified by category performance

- Cava and tourism: Leveraging Spain’s visitor base

- Target markets for concentrated growth efforts

- Marketing ideas for Cava

- Conclusion

Editorial Note: This essay was originally written as part of a professional wine examination. It has been lightly edited for clarity and web reading.

Introduction

Cava has a bright, some might even say sparkling, future as we look towards future growth trends, as long as it is willing to adopt some unconventional ideas while still holding on to its rich tradition and history.

In this paper I will discuss:

-

Wine and Cava specific growth rates, as context for how to project the future

-

Growth areas for Cava, based on current consumption data

-

Marketing ideas for Cava in consideration of the above

Wine and Cava specific growth rates

Understanding the macroeconomic context of the global wine industry is essential for projecting Cava’s trajectory. This section examines declining alcohol consumption patterns, the divergent performance of wine categories, and why sparkling wines—particularly Cava—present a compelling growth opportunity despite broader market headwinds.

Overall wine market decline

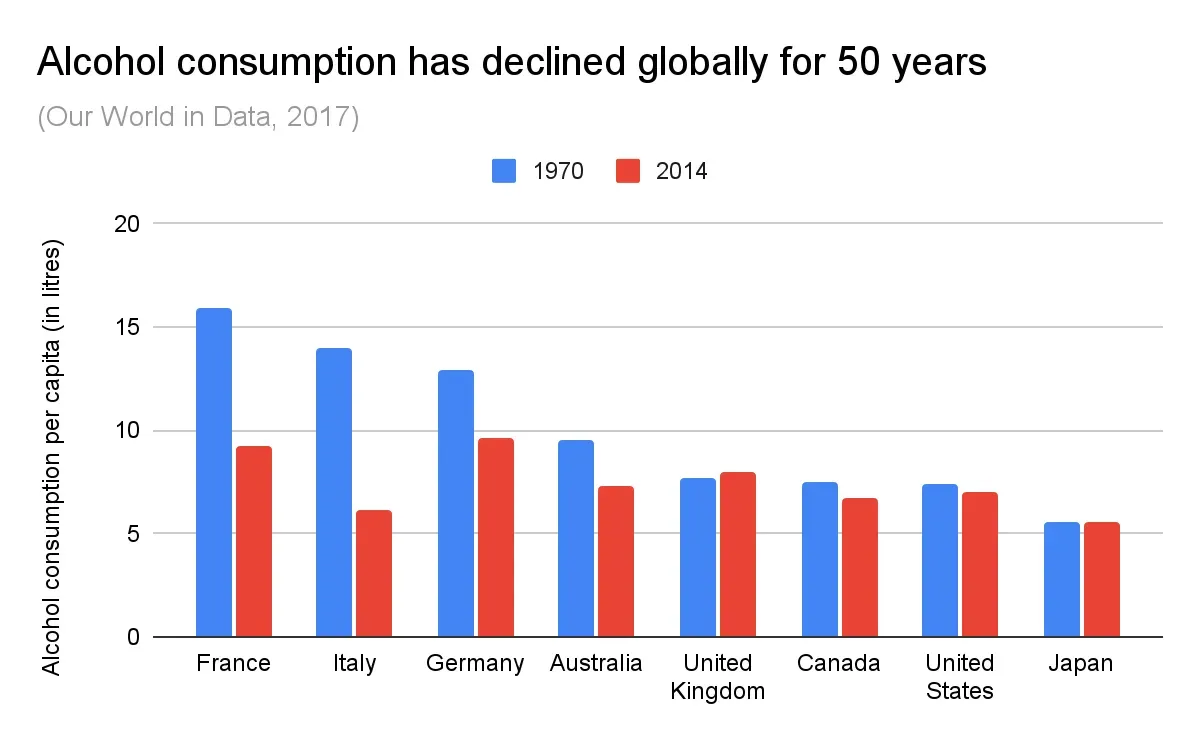

By now, it is no secret that the wine industry overall is facing difficulties. Alcohol consumption has declined in all major markets as part of a pattern 50 years in the making, and we should not expect a reversal in habits any time soon. Health, prices, habits have all changed, and the wine world is adapting to this new reality.

Figure 1: Wine consumption trends across major markets, illustrating the 50-year decline in overall alcohol consumption.

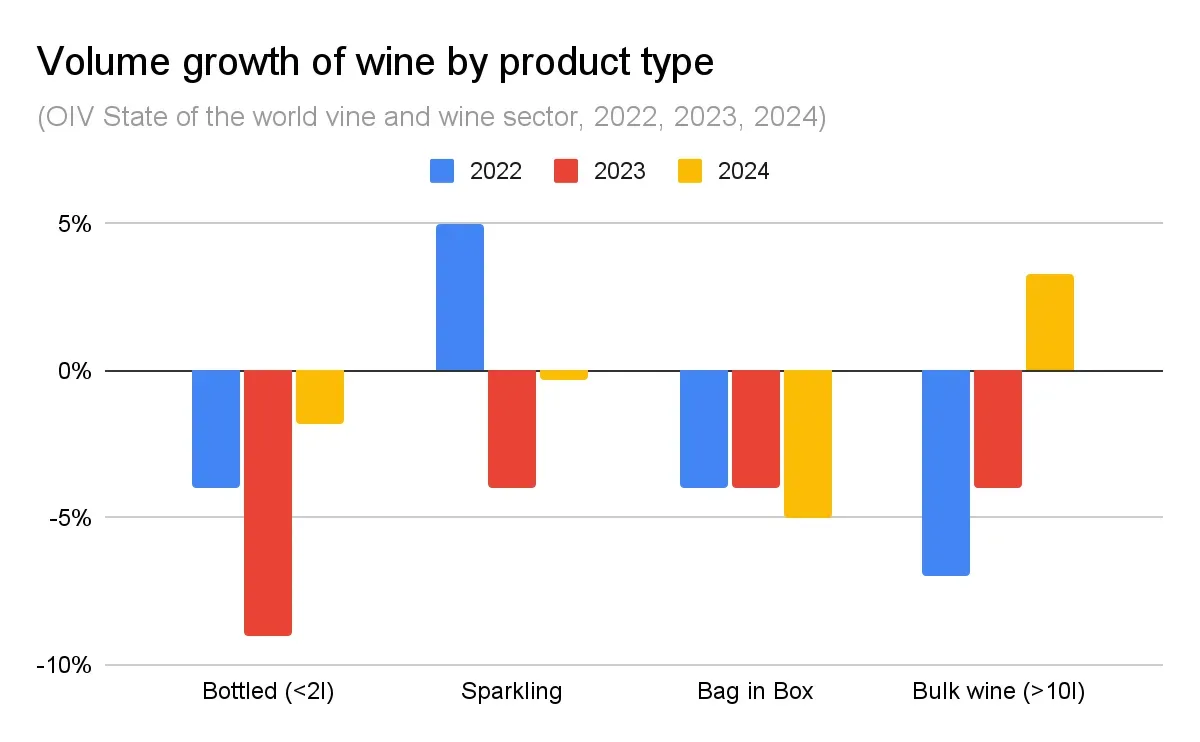

However, this decline in growth is not affecting the wine world evenly. Still wines have suffered the most, but sparkling wines have either had smaller declines, or even growth in some years.

Figure 2: Comparative growth trends for sparkling and still wine categories, highlighting the outperformance of sparkling wines.

Sparkling wine outlook and category divergence

The outlook for sparkling wines is also better than for still wines. According to IWSR, among the 3 major categories of still, sparkling, and fortified wine, the sparkling category is expected to have +1% cumulative annual growth rate (CAGR) from 2022 to 2027, unlike still wine which is expected to further decline with a -1% CAGR. It is a much better time to be a sparkling wine producer compared to a still wine producer, all other things being equal.

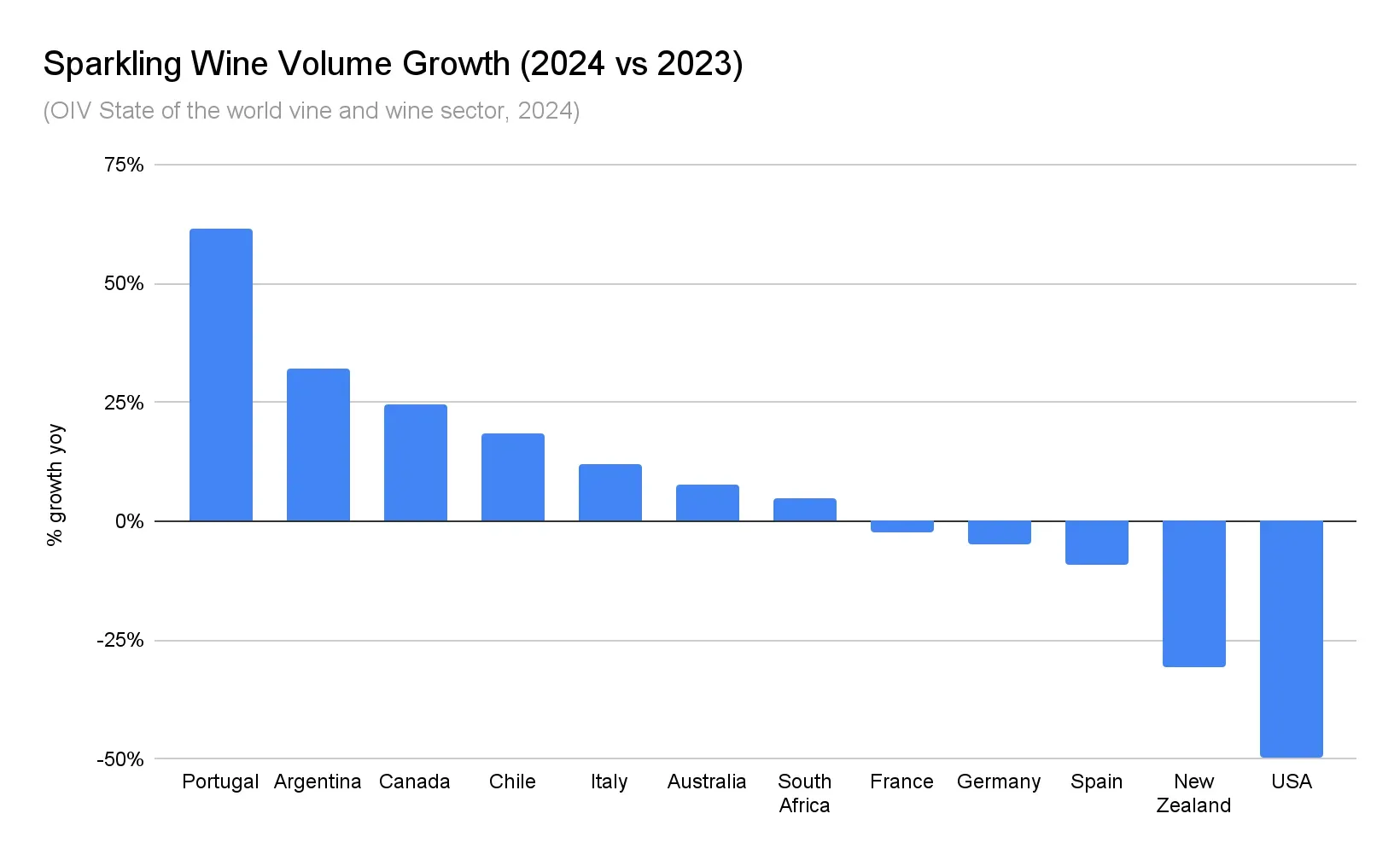

This divergence in outlooks becomes even clearer once we segment the data by country. Countries such as Portugal, Argentina, Canada have had >20% growth rates in volume of sparkling wine in 2024. Clearly, concluding that all of the wine world in all countries is declining is too generic of a statement, and misses the subtleties of consumer demand in some areas.

Huge opportunities in wine sales still exist, but understanding the market and consumer has become even more relevant in this fragmented age. There are still pockets of growth, but we must be more intentional in targeting these subsets. We should keep this in mind as we think about Cava’s future internationally.

Figure 3: Regional sparkling wine growth rates by country, demonstrating significant variation in market performance.

Given the volume growth projections, there is clearly still demand globally for sparkling wine, even more so in particular countries. It is now the moment for Cava to seize this opportunity to expand its customer base, and build the top of funnel marketing base for future growth. Doing so now, while being able to take advantage of the momentum of sparkling wine overall, will make the campaign much easier compared to attempting to reverse a decline, should that happen in the future. This is why it is essential for Cava to lay the groundwork now, to reap the benefits of brand recognition a few years down the line.

Cava’s performance relative to competing sparkling wines

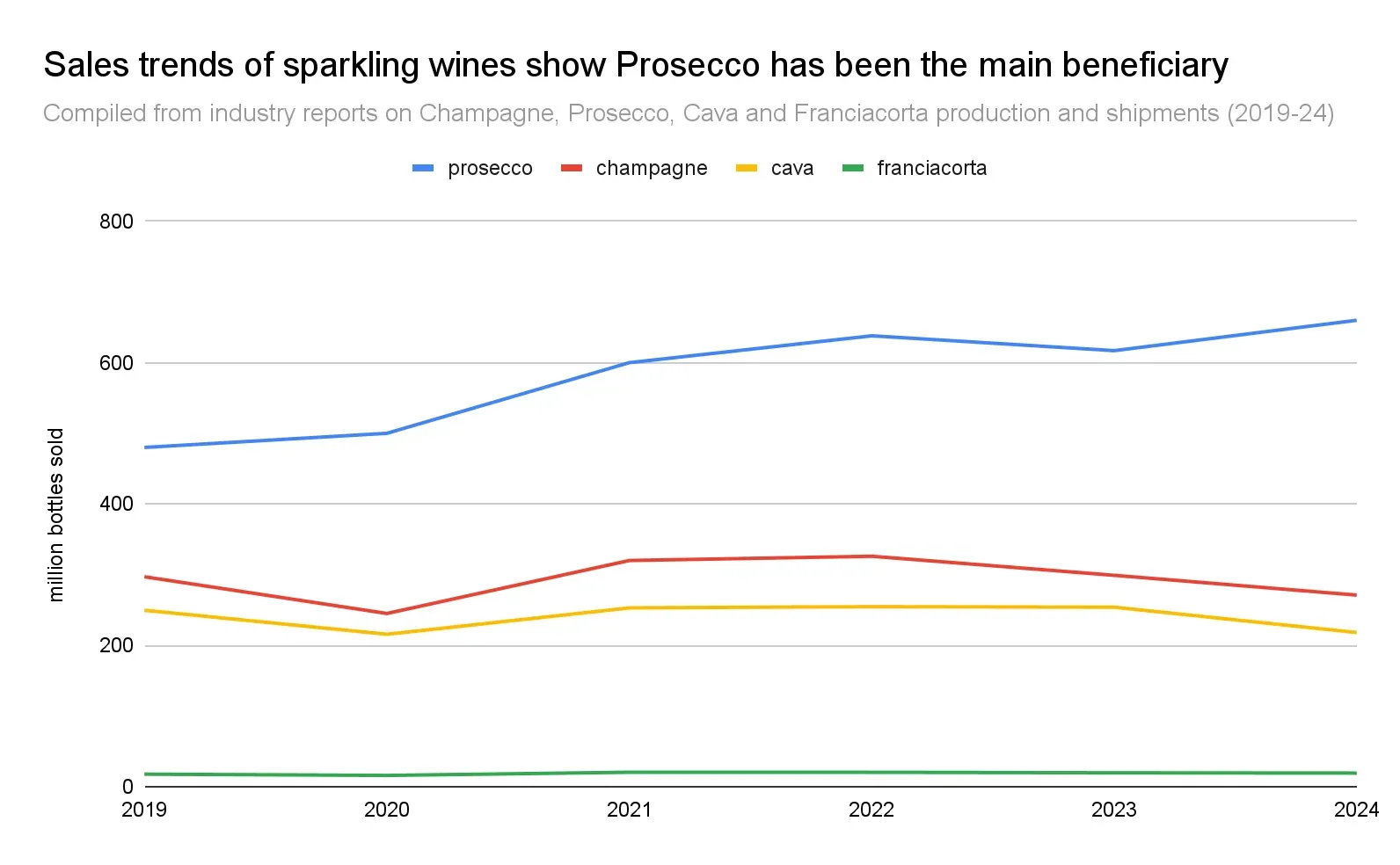

Looking closer at sparkling wine data split by major types, we see that Prosecco has been the main driver of volume growth in the past few years. This is in contrast to Cava, Champagne, Franciacorta growth being mostly flat.

In situations like these with diverging growth rates, we should:

-

Accept reality, and acknowledge the difference in sales volumes

-

Identify what Prosecco has been doing to continue growing

-

Assess what Cava would want to adopt, and what not to adopt, given its own culture

-

Get buy in from all stakeholders on how to develop Cava further

-

Set aside a long enough timeframe to implement the changes required

Figure 4: Comparative performance of major sparkling wine categories (Prosecco, Cava, Champagne, Franciacorta), showing volume and growth divergence.

Lessons from Prosecco’s success

Prosecco has benefited from several key advantages that have driven its market ascendancy:

-

Inexpensive price point, particularly compared to Champagne

-

Easy to drink, light, fruity, refreshing profile

-

Rebranding of the region and Glera grape in 2009

-

Marketing, publicity, and association with the Italian lifestyle

Cava can learn from the above, but with its own flavour:

-

While inexpensive and premium Cava will always still play an important role, there is likely a price point just above that of Prosecco, that is still affordable enough for the regular consumer, but also helping to signal higher quality. Emphasise the quality and value for money, but not the price

-

The citrus notes, high acidity, light body are plus points in favour of Cava, and should be leaned into more when promoting. The ability to pair well with food is also another huge bonus that more people need to be educated on; Cava promotional events and tastings should be conducted with food by default. In the completely opposite direction, longer lees aging times will help create products appealing to the niche super premium consumer segment, which will help with growth in value but not volume

-

Continuing with the current educational series (e.g. Cava Academy) and building the community for that will pay off in the medium term, as wine educators and bar managers will have Cava top of mind for them. The Cava brand name should continue to be the focus, rather than individual grapes - think about how many people know Prosecco but how few know what grape it uses

-

Regional, hyperlocal, specific products and experiences are trendy now. Cava should strongly emphasise the unique Spanish nature of the wine and the major zones. The sub zones are also a step in the right direction to increase the appeal for the premium price point consumer

Cava should not aim to compete or price, or brand itself as affordable Champagne, as that marketing strategy just increases customer awareness of other competitors while lowering the quality perception of Cava.

Cava should also not change its traditional methods of grape growing and production, and in fact actually lean into these aspects even more, in a world where everything is becoming commoditised and identical.

Growth areas for Cava

Part of Cava’s struggles the past 3 years have been due to the drought in Spain, leading to poor yields, scarce supply, and drop in sales volumes internationally. However, given that this is a temporary supply side issue rather than a demand side decline, we can expect a recovery in key markets, assuming the supply problems are resolved.

Identifying high-potential markets requires a systematic approach combining consumption data, tourism patterns, and cultural alignment. This section outlines methods for market selection and proposes priority markets for Cava’s expansion strategy.

Market selection methodology

There are a few ways to identify key growth countries for Cava.

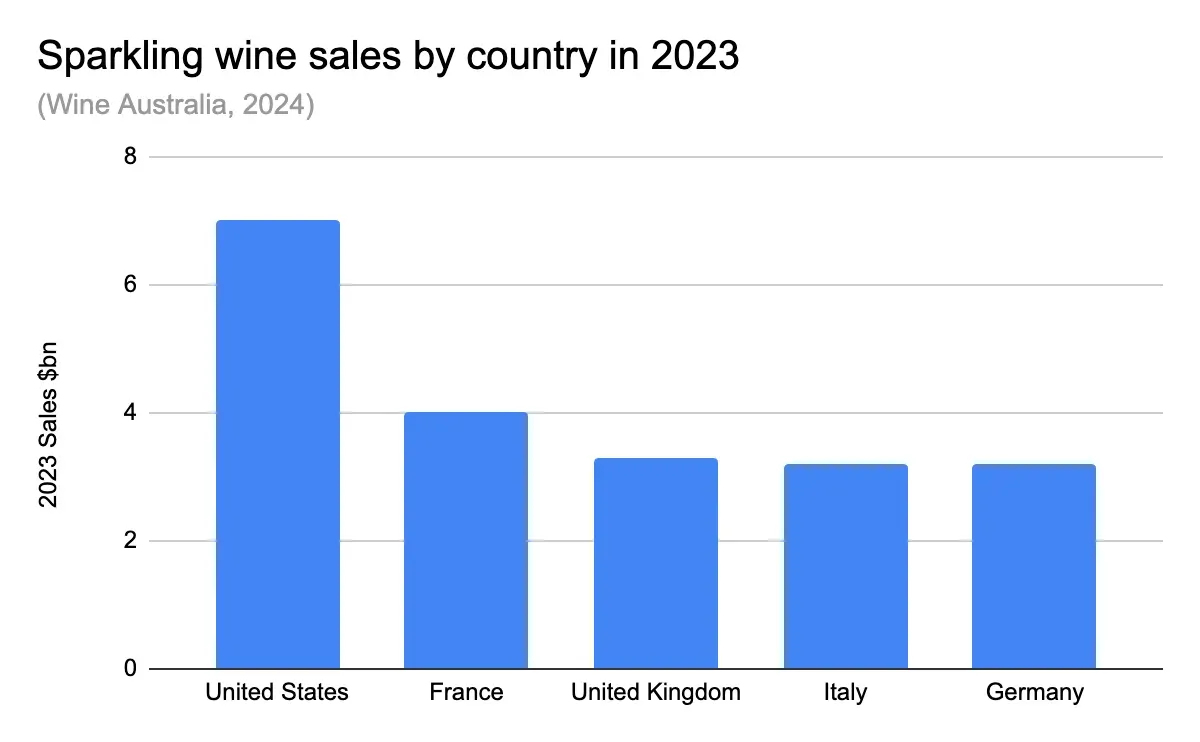

Firstly, taking a look at the largest markets for sparkling wine sales, we see the following top 5 areas, per Wine Australia:

France, Italy, and Germany have the majority of their sparkling wine sales as a direct consequence of their own local production methods. For example, France has 92% local sparkling wine, and Italy has 83% local. In contrast, the United States and United Kingdom continue to be mainly importers of sparkling wine, making them large markets.

This does not mean that the United States and United Kingdom are the only possible markets for Cava. Instead, it means that the marketing approach for Cava should differ across these top 5 countries. In countries with high local sparkling wine production, we can build curiosity about Cava rather than present Cava as a foreign competitor. In countries with high import percentages, we can emphasise the Spanish angle and history.

Growth markets identified by category performance

Secondly, referring back to the graph of sparkling wine growth by country discussed earlier, we see these countries as bright spots for growth:

-

Portugal

-

Argentina

-

Canada

-

Chile

-

Italy

Besides Italy, which was just mentioned above in the overall sparkling wine sales section, the rest of the markets are additions to the list of potential growth markets for Cava. Building the brand presence there now while the countries are still experiencing sales momentum will help accelerate growth efforts in the future.

The main idea should be to build awareness of Cava on both the inexpensive and premium price points, through Spanish cultural and food pairing themed events in those countries. We do not want to position ourselves as a cheap Champagne alternative or a Prosecco permutation, but want to constantly reinforce the Spanish heritage and history.

Cava and tourism: Leveraging Spain’s visitor base

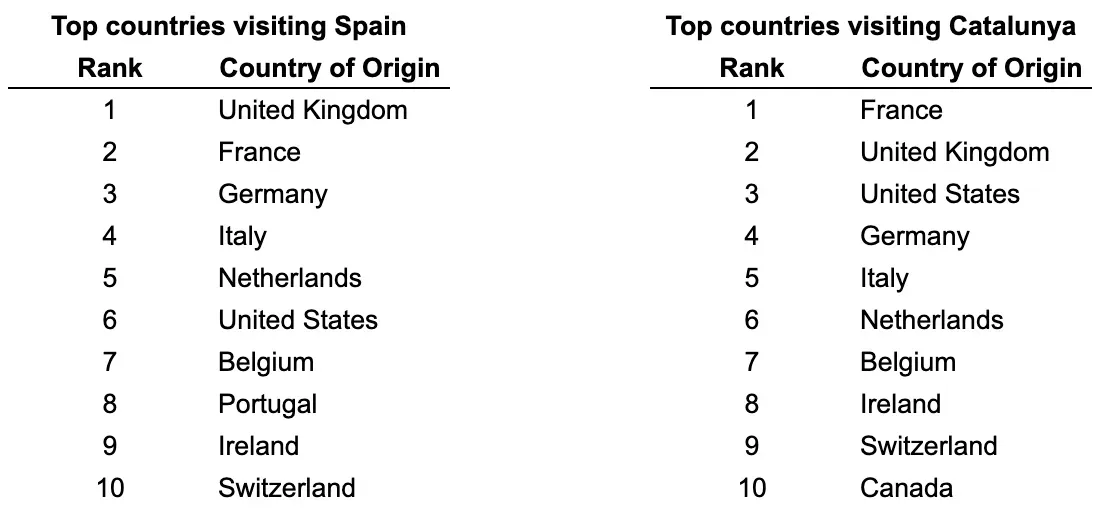

Thirdly, another way of identifying interesting countries for Cava is by taking a look at the top inbound tourism countries visiting Spain as a whole, and the Catalunya region in particular. It is likely that promoting the Spanish connection and heritage of Cava will be effective when selling into these countries, given the inherent interest of the consumer base.

Figure 5: Top source countries for inbound tourism to Spain and Catalunya, showing tourism flows that correlate with Cava promotional opportunities. Data sources: ine.es, idescat.cat

Based on the above, some other countries not previously identified include the Netherlands, Belgium, Ireland, Switzerland. Although most of these are naturally European countries due to the ease of tourism, note that Canada does appear in the top 10 list of tourist arrivals for the Catalunya region specifically.

Wine tourism for Cava is definitely a possibility, but growth efforts can take an even lighter touch than that. Working together with private tour agencies, public government boards, the Cava DO can make itself more visible at major tourist locations and events, to continue building awareness of the Spanish sparkling wine. It should be a stretch goal for every tourist leaving Spain to have had at least a taste of Cava while they were there. Airport tastings, winery tours, restaurant partnerships are all ways that this can be made to happen.

Target markets for concentrated growth efforts

We now have a good list of target markets to start with. To narrow it down, here are 3 proposed markets for growth, and also 3 underrated markets that could be interesting.

Growth markets: United Kingdom, Portugal, Argentina

Underrated markets: Canada, Belgium, Japan

Note that while Japan did not make the lists in the above cuts, it is added in here due to market knowledge of how the sparkling wine market is still growing there due to their culture and desire for premium drinks. Using it as a testing ground for marketing ideas can also help with land and expand efforts for the rest of the Asian market.

The market identification above is for focused outreach efforts, and is not meant to imply that other markets should be neglected. For example, it would be foolish to ignore the United States and not sell into it, given the size of the market there. However, we can likely get more return on marketing spend by making targeted campaigns for other relatively less competitive regions instead, and reinvest the revenue for more growth. The intent should be to build reinforcing growth loops that are self-funding.

Marketing ideas for Cava

Having identified promising markets and understood Cava’s competitive positioning, we now turn to unconventional promotional strategies that maintain brand integrity while building awareness. The following ideas prioritize long-term brand development and differentiation over short-term volume gains, ensuring Cava is positioned as a distinct Spanish product rather than a Champagne or Prosecco alternative.

The ideas may be less tried and true, but we want to always ensure that we still maintain the consistency of Cava, and respect the traditional ways of grape growing and wine production. We do not compromise on quality, but we do experiment with new promotional ideas.

Three ideas for marketing Cava are:

-

Canned Cava

-

No and low alcohol (NOLO) Cava

-

Personalised Cava bottle labels with the help of generative AI

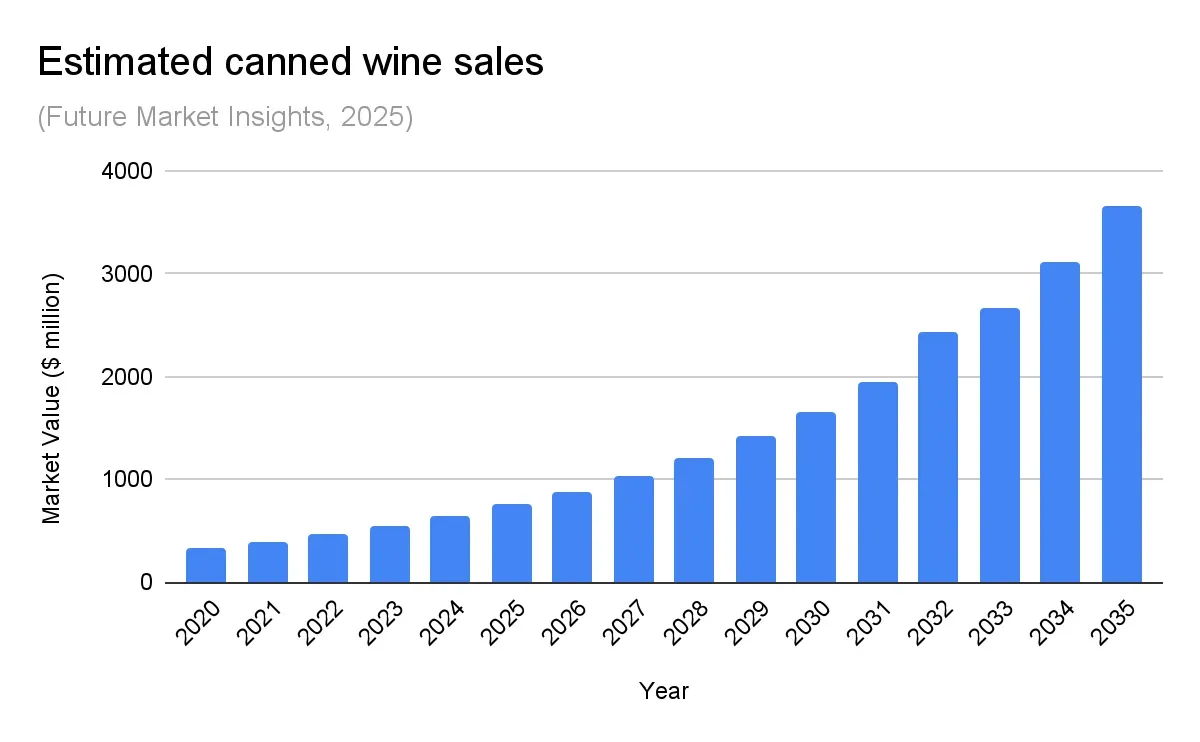

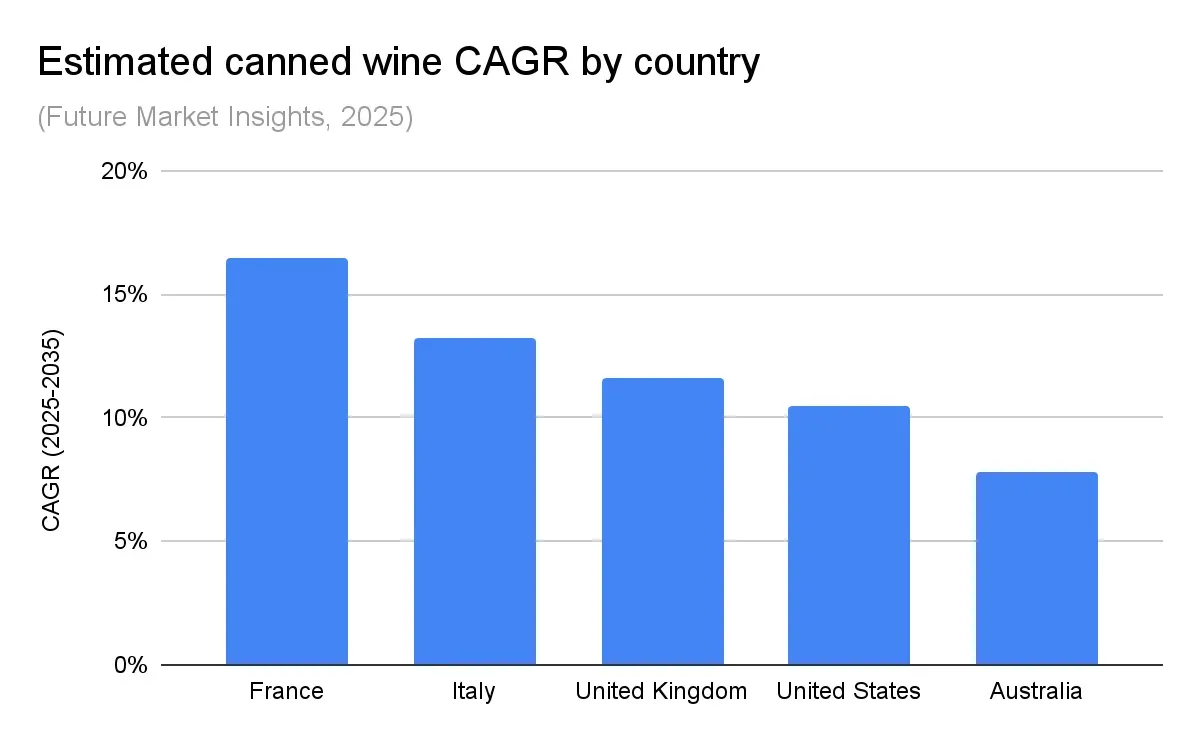

Canned wine sales are a high growth product segment, with Future Market Insights estimating a 17% CAGR over the next decade. Contrasting this with the decline in still wine sales overall, this represents a completely different paradigm, and Cava should capitalise on this trend.

Canned wine is becoming more popular due to convenience, ease of transport, and smaller portion sizes. For a younger generation of consumers that drinks less overall, it is easier to bring around smaller cans for drinks, rather than a bottle that they may not be able to finish. Some people may perceive canned wine to be healthier as well, given that some canned wine is wine with soda water added, which decreases the calories.

Sparkling wines are also a perfect pairing with the can format, due to the effervescent connection with other sparkling drinks triggering a sense of familiarity with the wine drinker. Cava can make use of this connection to offer quality wine in a trendy packaging format. Naturally, this would be more appropriate for the inexpensive, fruitier styles of Cava.

Surprisingly, all major markets are expected to have high growth for canned wine, which means that this marketing approach should work for Cava in all the suggested markets identified in the above growth areas section.

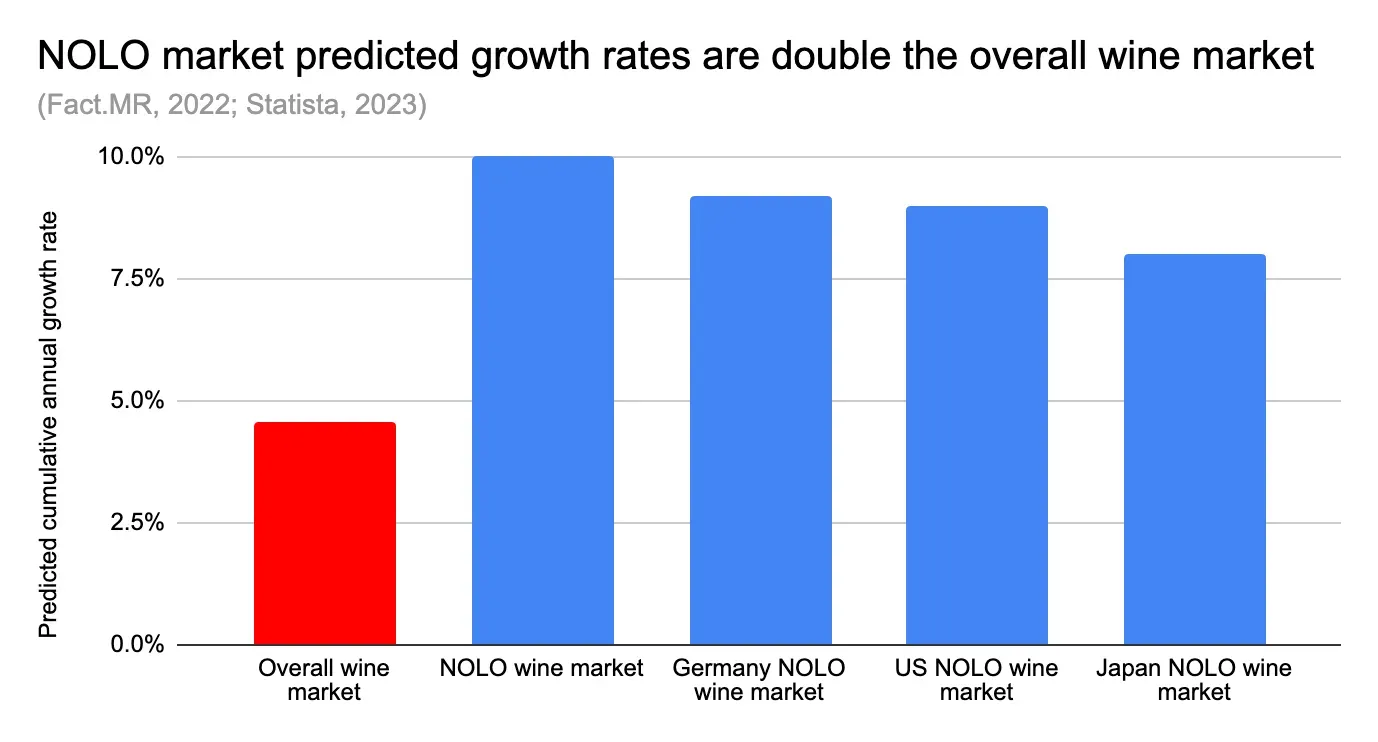

The no and low alcohol (NOLO) market is also another bright spot for wine. Growth rates are double that of the overall wine market, and also expected to be similar among major markets such as the US, Germany, and Japan. Health concerns, demographic changes, and improvements in product quality have resulted in this divergence of growth rates compared to overall wine.

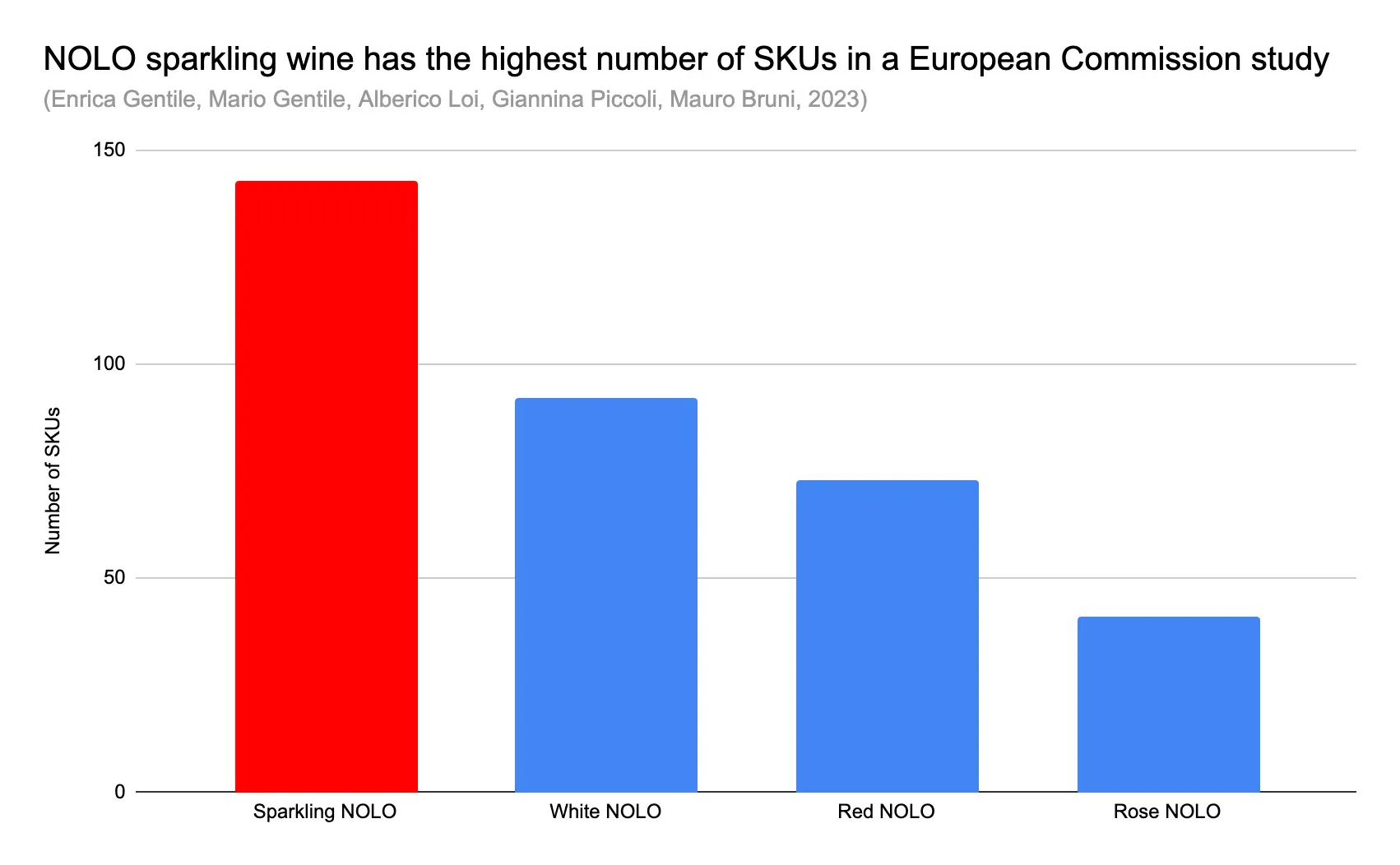

Among NOLO, sparkling wine has been the most attractive product category so far, due to the product quality being better received by consumers. Under current technology, it is harder to re-integrate the flavours and aromas removed during the de-alcoholisation process for red wines, which ends up causing a decline in taste. The bubbles in NOLO sparkling wine can help lift the flavours compared to NOLO still white wine, and make it more pleasant to drink. As a result, there are currently significantly more SKUs of NOLO sparkling wine than there are whites or reds. Cava is a natural fit for NOLO.

Cava can take advantage of this to make NOLO versions as well, with some even in cans, that will appeal to the more health conscious consumer. This would not be a novel idea. Vilarnau has already made two variants of Cava, a brut and a rose, that are without alcohol. As expected, the tasting profile of these variants are fresh and fruity, and the price is inexpensive. Cava should continue to push on this front while the trends are still in its favour, especially since it will take time for producers to set up the production process for NOLO.

Now that we’ve had 2 ideas for inexpensive Cava, the remaining idea is for the premium and super premium Cava segment. The Cava de Paraje Calificado would be the ideal product type for this, and possibly even the extremely long lees aging that some producers are experimenting with as well. The intent is to focus on smaller production, higher quality, so that the AI labelling idea is easier to execute.

At this price point and quality level, consumers are expecting unique products. What better way to do so, than make the bottle labelling unique per individual order, a result of their own design?

With the help of generative AI tools, consumers will be able to design their own bottle label, subject to a minimum order amount. Their premium Cava case will be one of a kind, sure to scratch the collector’s itch that many of the clients in this segment have. A simple but more expensive option would be to use paid tools such as Google AI Studio’s Nano Banana, which created this image below in less than a minute. Imagine the possibilities for the consumer here.

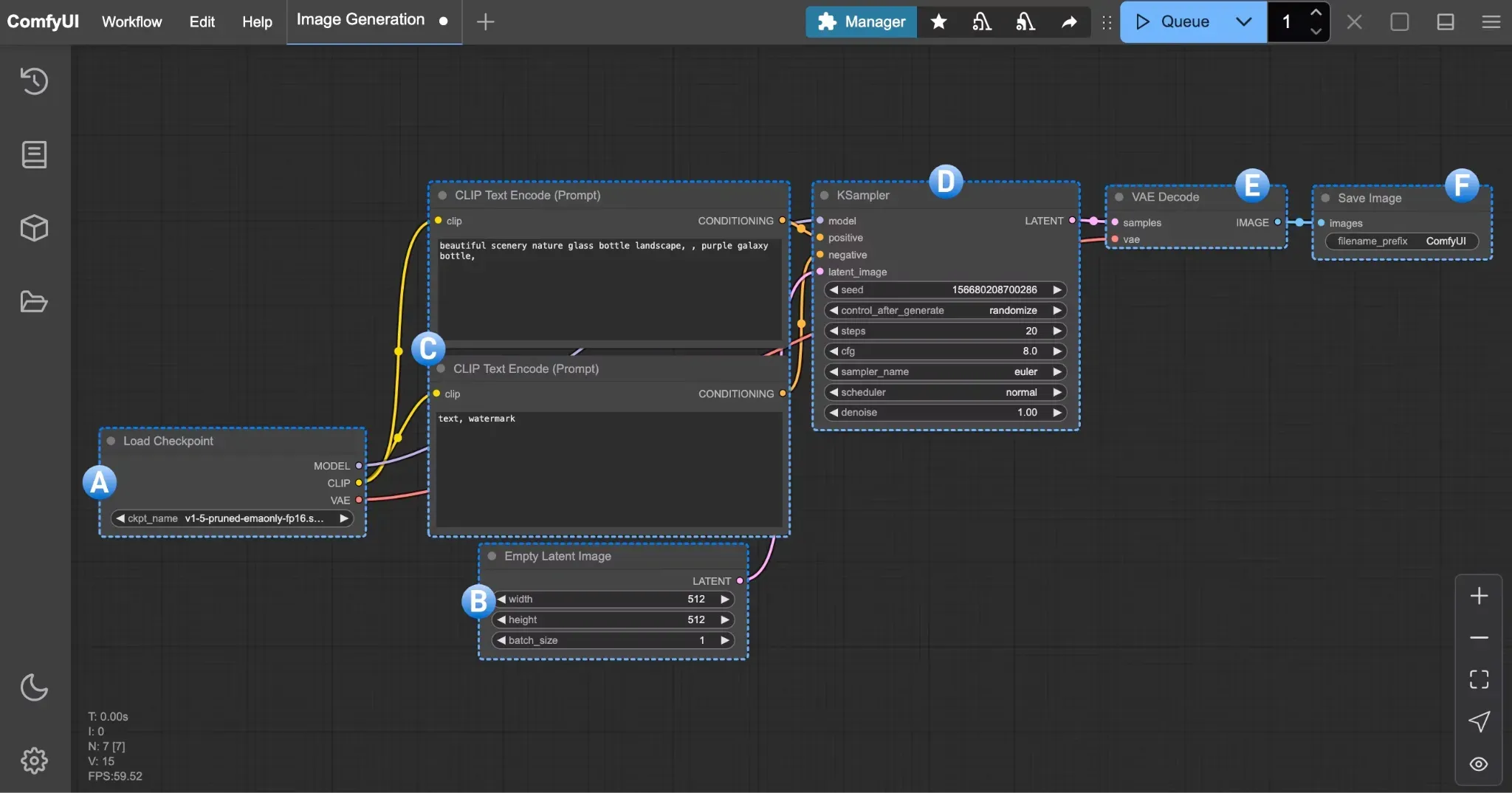

The more complicated but cheaper option in the long run would be to use custom tools such as ComfyUI below together with purchased CPU and GPU hardware, to do the image generation ourselves. In other words, the wineries would have to buy the computing equipment, and set up the backend and frontend software tools for users to be able to easily enter text for image generation.

Although this would be harder to set up, it would be cheaper after initial capital costs are depreciated, due to the lower recurring cost nature vs the subscription and API fees for the paid tool options. There would be more control over the entire end to end process as well.

Source: ComfyUI

The premium price point of the product for this idea is required, due to the higher effort and costs involved in producing the unique bottlings. Since we are targeting the high net worth customer segment, the incremental cost from the customisation is unlikely to impact demand.

Conclusion

Cava has much to look forward to in the next decade, despite the worrying trends overall for the wine market. There still remain many countries where sparkling wine and especially Spanish wine will be growth engines. Cava can further take advantage of canned wine, NOLO, and generative AI tools to appeal more to the modern consumer. It does not have to change its cultural history, but it does have to experiment with new marketing approaches to expect changes in growth for the future.

References

-

The art of drinks. (2025, August 19). Vilarnau The New Non-Alcoholic Cava From Spain. The Art Of Drinks. Retrieved October 24, 2025, from https://theartofdrinks.nl/en/new-vilarnau-cava-0-0/

-

Baker, N. (2025, January 23). Champagne shipments fall 9% in 2024. The Finest Bubble. Retrieved October 23, 2025, from https://thefinestbubble.com/news-and-reviews/champagne-shipments-fall-9-in-2024/

-

Conegliano Valdobbiadene DOCG. (n.d.). 2022 Data. Prosecco. Retrieved 2025, from https://www.prosecco.it/wp-content/uploads/2023/09/Economic-Report-2022-PDF-ENG.pdf

-

Consorzio Tutela Prosecco DOC. (n.d.). News — News Istituzionali. Prosecco. Retrieved 2025, from https://www.prosecco.wine/en/data-analysis-prosecco/#:~:text=other%20wine%2C%20going%20from%20about,%E2%80%9D

-

DO CAVA Global Report 2024 ENG. (n.d.). D.O. Cava. Retrieved October 23, 2025, from https://www.cava.wine/documents/628/DO_CAVA_Global_Report_2024_ENG_mobile.pdf

-

Future Market Insights. (n.d.). Canned Wine Market. Future Market Insights. Retrieved 2025, from https://www.futuremarketinsights.com/reports/canned-wine-market

-

Instituto Nacional de Estadistica. (n.d.). Movimientos Turísticos en Fronteras. INE. Retrieved 2025, from https://www.ine.es/jaxiT3/Datos.htm?t=23984#_tabs-tabla

-

IWSR. (2024, 02 15). Seven key trends that will shape the global wine industry in 2024. IWSR. Retrieved 2025, from https://www.theiwsr.com/insight/seven-key-trends-that-will-shape-the-global-wine-industry-in-2024/#:~:text=Nonetheless%2C%20opportunities%20continue%20for%20sparkling%20wine%20%E2%80%93,20%20markets%20between%20H1%202019%20and%202023.

-

LA Times. (2021, 09 19). Check the attitude. There are more reasons than ever to try canned wines. Los Angeles Times. Retrieved 2025, from https://www.latimes.com/food/story/2021-09-19/check-the-attitude-there-are-more-reasons-than-ever-to-try-canned-wines

-

OIV. (n.d.). STATE OF THE WORLD VINE AND WINE SECTOR IN 2022. OIV. Retrieved 2025, from https://www.oiv.int/sites/default/files/documents/OIV_State_of_the_world_Vine_and_Wine_sector_in_2022_2.pdf

-

OIV. (2024, April 21). STATE OF THE WORLD VINE AND WINE SECTOR IN 2023. OIV. Retrieved October 23, 2025, from https://www.oiv.int/sites/default/files/2024-04/OIV_STATE_OF_THE_WORLD_VINE_AND_WINE_SECTOR_IN_2023.pdf

-

OIV. (2024). Table 5 Major Wine Exporters. State of the world vine and wine sector in 2024. Retrieved from https://www.oiv.int/sites/default/files/2025-04/OIV-State_of_the_World_Vine-and-Wine-Sector-in-2024.pdf

-

Consorzio per la tutela del Franciacorta. (n.d.). Economic Observatory. Franciacorta. Retrieved 2025, from https://franciacorta.wine/en/consortium/data/#:~:text=Summary%20of%20the%20previous%20year%E2%80%99s,2023

-

Statistical Institute of Catalonia. (n.d.). Foreign tourists. idescat. Retrieved 2025, from https://www.idescat.cat/indicadors/?id=aec&n=15547&lang=en#:~:text=Total%2019%2C940,6.1

-

Wine Australia. (2024, 11 26). Sparkling wine sales… Bubble or pop? Wine Australia. Retrieved 2025, from https://www.wineaustralia.com/news/market-bulletin/issue-327

-

Wine Intelligence. (n.d.). Cava’s Struggles in 2024: Drought, Declining Sales, and the Fight to Regain Momentum. Wine Intelligence. Retrieved 2025, from https://wine-intelligence.com/blogs/wine-news-insights-wine-intelligence-trends-data-reports/cava-s-struggles-in-2024-drought-declining-sales-and-the-fight-to-regain-momentum

Comments